Are you worried about the impact of a ticket might be on your insurance? We cover the different types of traffic ticket convictions and the impact that they might have on your rates.

Here's what a traffic ticket means for you

Uh oh! You’ve found yourself on the side of the road with flashing blue and red lights in your rearview mirror. As you hand over (or show on your phone!) your insurance slips, you’re probably wondering what a ticket will do to your insurance.

Insurance companies each have their own policies for how they charge for a driving conviction. It is important to note that only convictions are considered against your record. In general, insurance companies are not too concerned about the demerit points associated with your conviction. The number of convictions and the severity of the offense play a more prominent role into the rates you may experience at your insurance renewal.

How are convictions classified?

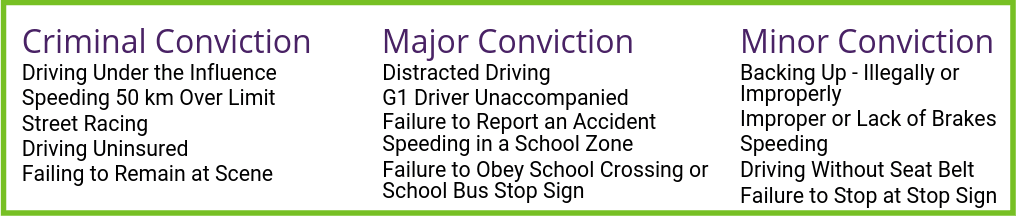

Traffic tickets are divided into three main categories – minor, major, and criminal convictions. Each of these types can affect your car insurance rates, though the more severe will usually correlate with greater impacts.

Some examples of convictions in each category are:

What can a conviction do to your rates?

Each insurance company, as mentioned, has their own rules and regulations for how a conviction will impact your insurance. Some companies will not renew your policy, while others charge a higher premium or a surcharge.

Typically, your conviction will not affect your insurance rates until your next renewal date. You essentially have a contract with the insurance company for this year. Once you reach the renewal date, they will reevaluate you and your risk profile.

Here’s how these convictions might look at your time of renewal:

- Serious or Criminal Convictions: You may be charged 100% more for each conviction and likely will not be renewed by your insurance company.

- Major Convictions: You may be charged 25% more for each conviction and may not be renewed. A major conviction (even just one) increases your risk profile sufficiently and will make you an undesirable candidate to other insurance companies as well.

- Minor Convictions:

- 1 Minor Conviction: 1 minor conviction has minimal impact on rates, but you will not be eligible for a conviction free discount.

- 2 Minor Convictions: Some companies charge 20% more for 2 minor convictions and 20% more for each additional conviction.

Convictions stay on your driving record for 3 three years

Convictions stay on your driving record for 3 years starting from the conviction date. However, you will likely only see a change in your insurance at your renewal period.

If your conviction impacts your insurance rates or terms, the increased rates will be reflected in your policy renewal for 3 years. The same thing applies when a conviction falls off your driving record after 3 years. You will no longer be rated for the conviction and your insurance rates will drop at the time of your policy renewal.

What your insurance broker can do for you

First and foremost, your insurance broker will want to make sure that you are safe after a driving conviction. Once we know that you’re okay, we will work with you to file a claim with your insurance company (if necessary) and ensure that you have the proper documentation to keep you on the road.

Here at McConville Omni, we have over 50 insurance companies that we can access to get you proper insurance coverage while on the road. Your broker submits your information to these insurance companies and shops through their offerings to find you the best policy at a competitive rate.

Luckily for you, you get to leave all the hard work with us!

Relax with the knowledge that you're completely covered while on the road

We can work with you to identify the best coverage at the right price. Our experienced brokers are ready to help you navigate the complex world of vehicle insurance.